Non-Jordanian ownership in companies listed on the ASE Reached 48.1%, of which 36.8% for institutional investors

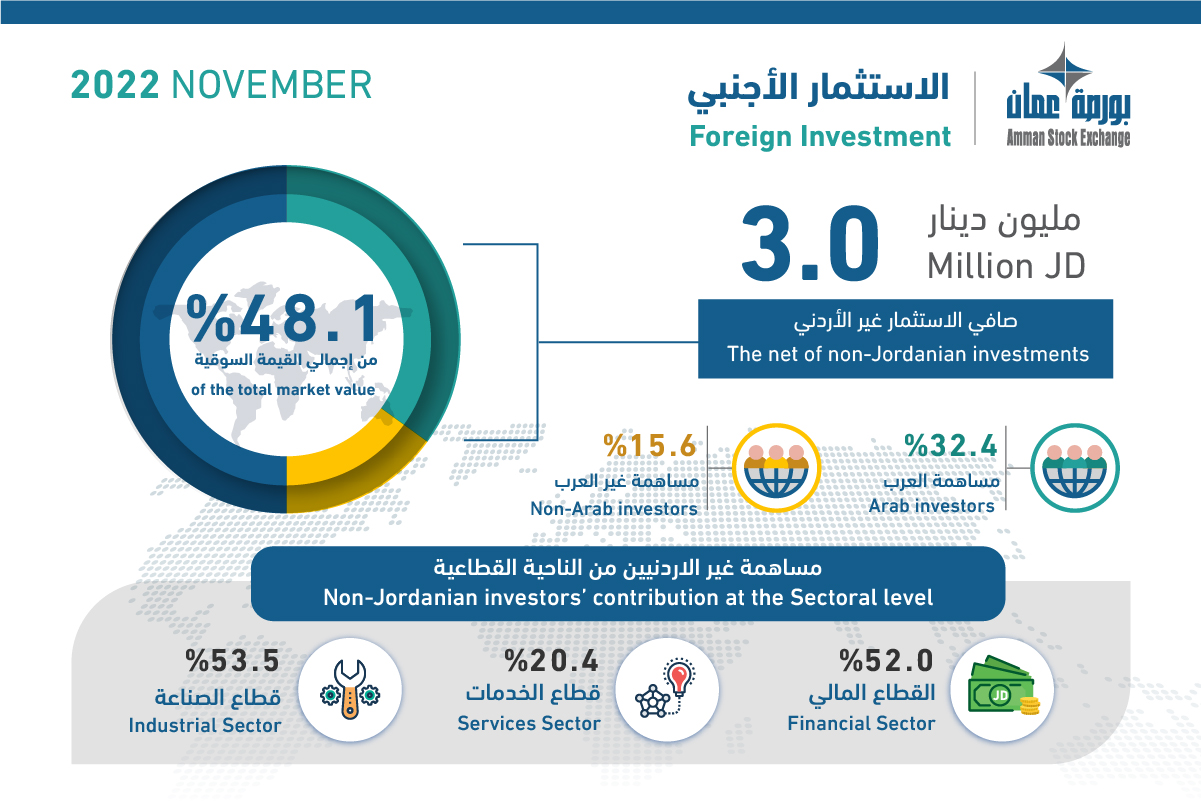

Amman Stock Exchange (ASE) revealed that the value of shares bought by non-Jordanian investors at the ASE in November 2022 was JD15.9 million, representing 13.1% of the overall trading value, while the value of shares sold by them amounted to JD12.9 million. As a result, the net of non-Jordanian investments in November 2022 showed a positive value of JD3.0 million, whereas the net of non-Jordanian investments showed a negative value of JD1.9 million during the same month of 2021.

The value of shares bought by non-Jordanian investors since the beginning of the year until the end of November 2022 was JD263.9 million, representing 14.0% of the overall trading value, while the value of shares sold by them amounted to JD334.8 million. As a result, the net of non-Jordanian investments showed a negative value of JD70.9 million, whereas the net of non-Jordanian investments showed a negative value of JD32.1 million for the same period of 2021.

Arab investors purchases during November 2022 were JD8.0 million, or 50.5% of the overall purchases by non-Jordanians, while the value of non-Arab purchases amounted to JD7.9 million, constituting 49.5% of the overall purchases by non-Jordanians. Arab investors sales amounted to JD8.1 million, or 62.7% of non-Jordanians total sales, while the value of non-Arab sales amounted to JD4.8 million, representing 37.3% of the total sales by non-Jordanians. As a result, the net of Arab investments showed a negative value of JD0.1 million, whereas the net of non-Arab investments showed a positive value of JD3.1 million in November 2022.

Hence, non-Jordanian investors' ownership in companies listed on ASE as of end of November 2022 represented 48.1% of the total market value, of which 36.8% for institutional investors including companies, institutions and funds. Arab investors own 32.4% and non-Arab investors own 15.6%. At the sectoral level, the non-Jordanian ownership in the financial sector was 52.0%, in the services sector was 20.4% and 53.5% in the industrial sector.